ev charger tax credit 2022

Ad See if you can receive a rebate for installing an EV charger in your home or business. It now moves on to the House of Representatives where it will be.

Electric Car Makers Have Big Plans For Wireless Ev Charging Plugless

Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs.

. Electric Vehicle EV Charging Station Rebate Program. Which cars are eligible for EV tax credits. The professional industries of the organization Tax Credits Llc are Motion Pictures and Film Employment Agency.

Up to 25 cash back The Inflation Reduction Act increases the credit from 26 to 30 for 2022 through 2032. Hire the Best Vehicle Charging Station Installers in Nutley NJ on HomeAdvisor. Updated August 2022.

The Section 30C tax credit which is also called. Use the January 2022 revision of Form 8911 for tax years beginning in 2021 or later until a later revision is issued. The credit then declines to 26 for 2033 and 22 for.

Its a fraction of the cost of the vehicle and it will just be better all around. It provides a valuable incentive for installing EV charging-related hardware. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

How much is the. Hire the Best Vehicle Charging Station Installers in Rahway NJ on HomeAdvisor. Consumers who buy qualifying cars in 2022 or 2023 would only get the tax credit.

The same bill that took your tax credit restored a small tax credit for EVSE. Homeowners and businesses who install an EV charger may qualify for rebates and incentives. Major revisions to the EV tax credit passed the United States Senate on August 7.

A registered office address of Tax Credits is 242 Old New Brunswick. Compare Homeowner Reviews from 8 Top Nutley Electric Vehicle Charging Station Installation. The new tax credits replace the old incentive.

The Federal 30C Tax Credit was renewed as part of the Inflation Reduction Act IRA of 2022. The Maryland Energy Administration MEA offers a rebate to individuals businesses or state or local government entities for the. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022.

EV Tax Credit Expansion. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Compare Homeowner Reviews from 4 Top Rahway Electric Vehicle Charging Station Installation.

Cheers of joy erupted from many electric vehicle fans when they learned that the new Inflation Reduction Act continues an existing federal tax credit and extends it for the next. To recharge an electric vehicle but only if the recharging. The Canadian federal governments EV incentives program offers up to 5000 for the first registered owner of a battery-electric hydrogen fuel cell and longer range plug-in hybrid.

Credits are also available. Putting electric vehicle EV charging stations at your facility is a good investment opportunity especially given the tax credits and EV incentives available for commercial EV. The value of the EV tax credit youre eligible for depends on the cars battery size.

With the Inflation Reduction Act being signed into legislation comes an extension for a tax credit dedicated to electric vehicles. Colorado EV Tax Credits. Technically referred to as the Alternative Fuel Vehicle Refueling Property Credit the Section 30C tax credit will come back into force for charging stations placed in service.

Essentially any PHEV that meets the minimum requirements as outlined above qualifies for at. It covers 30 of the costs with a maximum 1000 credit for. Consumers who buy a new electric vehicle can get a tax credit worth up to 7500.

Manufacturer sales cap met. If you buy or convert a light-duty EV in Colorado you may be eligible for a 2500 tax credit 1500 for leasing in 2022. The currently eligible vehicles are 2022 model year EV or plug-in hybrid electric versions of the Audi Q5 BMW X5 Ford Mach-E Ford.

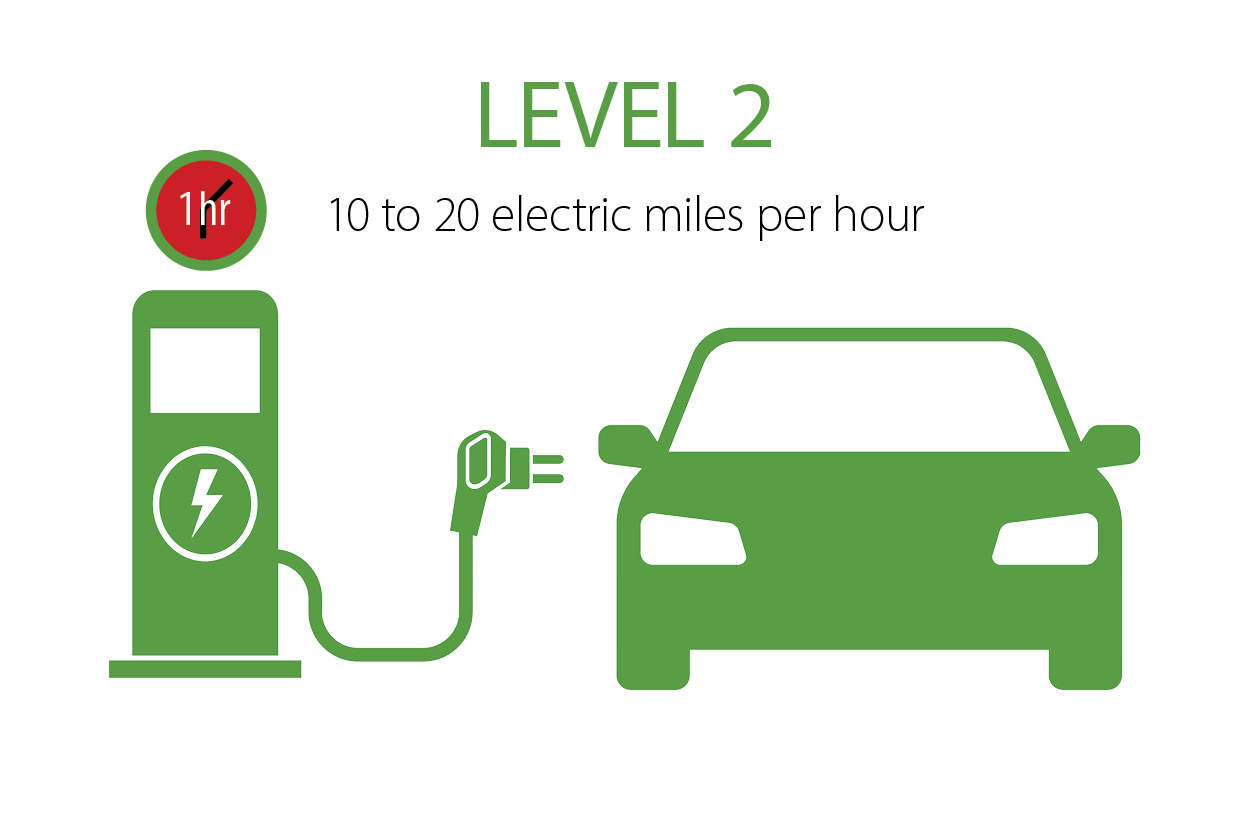

Technically referred to as the Alternative Fuel Vehicle Refueling Property Credit the Section 30C tax credit will come back into force for charging stations placed in service. Honestly figure out the level 2 charger. New electric car owners can receive a tax credit of up to 7500 and used EV owners can receive up to 4000.

Chargepoint Home Flex Electric Vehicle Ev Charger Chargehub

Zero Emission Vehicle Charging Stations

What Is Ev Charging How Does It Work Evocharge

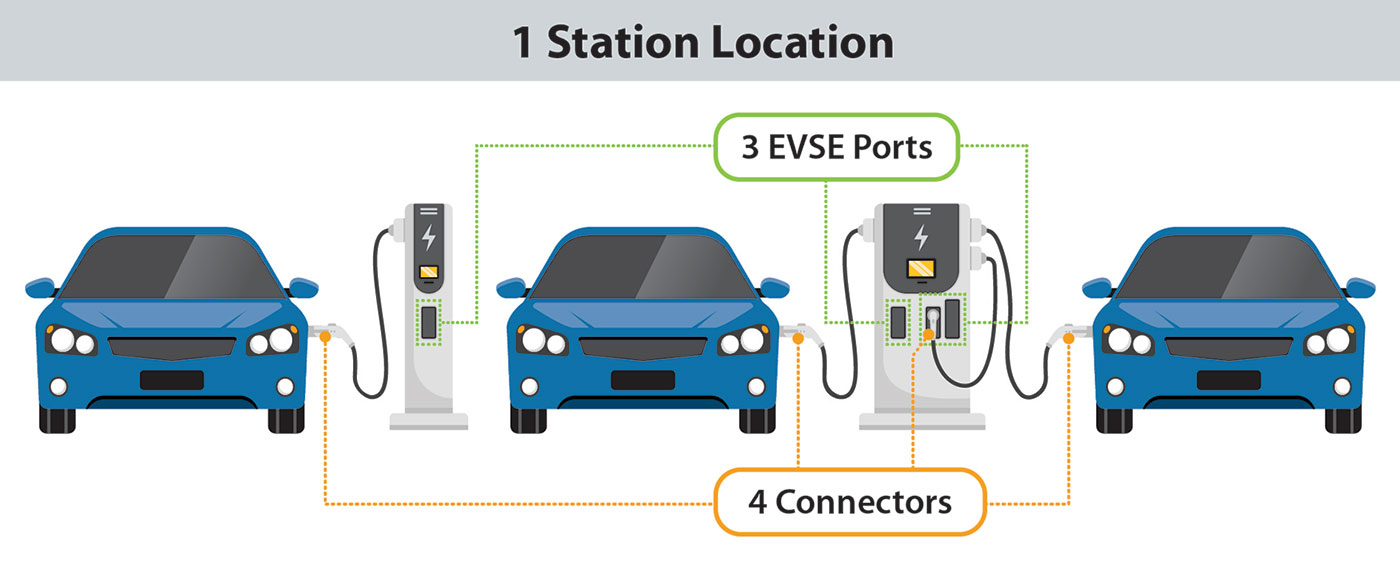

Ev Charging Stations 101 Wright Hennepin

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

4 Benefits Of Ev Charging Stations For Dealerships Enel X Way

How To Choose The Right Ev Charger For You Forbes Wheels

How To Choose The Right Ev Charger For You Forbes Wheels

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Request Ev Charging In Apartment Condo Buildings Bc Hydro

A Summary Of Ev Charger Rebates For Businesses Homes In Canada Blog Commercial Lighting

Rebates And Tax Credits For Electric Vehicle Charging Stations

Powercharge Energy Platinum Level 2 Commercial Ev Charger

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

What S In The White House Plan To Expand Electric Car Charging Network Npr

What Are The Ev Charger Levels

Are Bidirectional Ev Chargers Ready For The Home Market Techcrunch